As the first sentence, I’m going to say that you shouldn’t decide an entity based on what a website tells you; your choice can have significant tax and liability consequences, and it might not be possible to go back and change things. Take this post as background knowledge, and then talk to a professional with your newfound information.

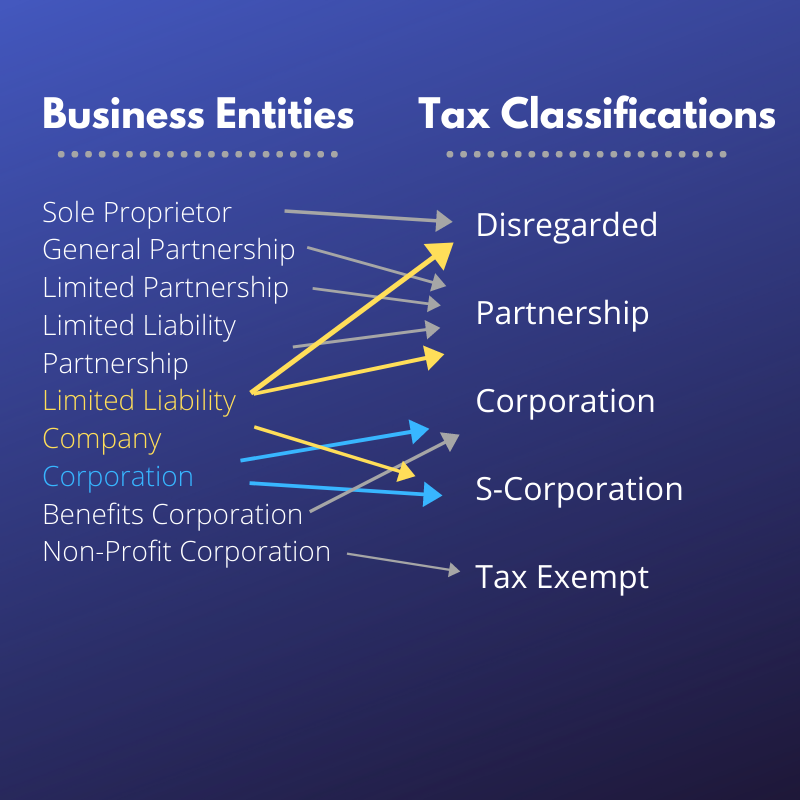

Now, to the actual matter. Below you’ll see two categories, business entity types, and taxation classifications. You might notice there is some overlap, but that the lists aren’t perfect matches. That’s because business entities are constructs of the State, taxation classifications are constructs of the Federal Government, and they don’t recognize each other’s systems. You might also notice that there’s no LLC in Taxation, and that’s because the Federal Government doesn’t recognize LLCs for taxation purposes. You’ll also notice that there’s no S-Corp in the entities list, and that’s because S-Corps are not businesses, they are just a way a business can choose to be taxed. Read it out loud with me: *S-Corps are not business entities*.

I’ll go through each for-profit vehicle in the Entity column, referencing the Taxation column where appropriate. As background, there three main reasons that people start companies: a) to create a shield from liability, b) to optimize taxation, and c) to create management structure.

Sole Proprietor

This is the easiest entity to form because there are no formalities. We all have an inherent ability to just go out and be in business, whether that means selling samosas, building furniture, or dealing in any other good or service your heart desires. It’s also literally the (almost) worst business vehicle you can have.

Sole Proprietors have unlimited liability for their actions. That means that if one of your samosas gives someone food poisoning or chips their tooth, and that person sues you, all of your assets can be attached in the lawsuit. Whether it’s your house, your car, your bank account or theoretically, the actual shirt off your back, you can lose it in a lawsuit related to your business conduct as a sole proprietor. If you accidentally hit someone with a 2x4 on your way out of Home Depot, or if that gorgeous handmade chair breaks and stabs someone in the side, all of your assets can be attached.

Because there is unlimited liability, it is very rare that I recommend someone proceed as a Sole Proprietor.

General Partnership

This is the second easiest form because all you need to do is find a partner or few. Just like with Sole Proprietors, there are no formalities, and there is unlimited liability. The big difference is that in general partnerships there is another person making decisions with you, and your decisions affect each other. I don’t just mean emotionally, but also economically, because in a general partnership you share liability for the actions of your partners. That’s right, if your partner does something that gets the business sued, all of your personal assets get attached because you are as responsible for their actions as they are. Feel free to let that sink in.

What gets even crazier is that in many states, you don’t even formally have to go into business with the person, you just need to represent that you’re partners. Theoretically, the following situation could happen: you’re in a bar with a friend Al and he jokes to someone, let’s call him Simon, that you and Al are partners in a car repair business. The next day Simon hires Al to fix his car, and chaos ensues because Al doesn’t know what he’s doing. Because you didn’t specifically tell Simon that Al was joking, it’s reasonable for Simon to believe that you are business partners, and that will result in your name being added to the lawsuit.

To specify, this is literally the worst form of business entity you can have. It’s also the default if you a) start a business, with b) one or more other people, and c) don’t have a legitimate company registered in front of you. Don’t be like Al, choose a different adventure.

Limited Partnerships (LPs) and Limited Liability Partnerships (LLPs)

Limited Partnerships were popular in the 1970s and 1980s because LLPs and LLCs didn’t exist yet, and so people didn’t have other options. A Limited Partnership has a) a General Partner/Partners that operate the business on a daily basis, and who have unlimited liability on behalf of the business, and b) Limited Partners that don’t really participate (kind of like silent partners), and have limited liability. This form of business isn’t really popular anymore, but if you’re especially pressed to form it out of nostalgia, I’d suggest that the General Partner be a company rather than a person (your state’s rules allowing).

Limited Liability Partnerships are totally reasonable entities, but you rarely find them outside of law firms and accounting firms, because LLCs can do whatever LLPs can, and usually better. LLPs have limited liability for all of the partners, and also protection from liability for the acts of another partner, like your dental practice partner getting sued for malpractice. You really want a robust Partnership Agreement if you and your team decide to take this route.

Limited Liability Companies (LLCs)

Limited Liability Companies are a fairly new business vehicle. It wasn’t really recognized across the country until the mid to late 1990s. Despite it being so new, people that don’t know the first thing about corporate law somehow know that they need an LLC.

The characteristics of LLCs are that they have limited liability for all of their Members (not partners or shareholders, but members), they are pass through entities, and they are the most flexible form of entity around.

Starting with liability, that means, generally, your losses in the business are limited to your investment. If that disappears, whether because you got sued and lost it all, or because your soy sauce ice cream business wasn’t the hit you thought, you can pretty much walk away without anything hitting your personal assets.

A pass through entity means that the LLC is taxed like a partnership, and for all intents and purposes, the Federal Government will pretend it’s not there. The company will handle all costs and expenses, but it won’t get taxed on profits. Instead, the owners will get taxed directly, usually in proportion to their ownership, with the LLC bypassed at tax time.

The flexibility though, is one of the best reasons to start an LLC, because it allows you to structure the company in almost any way you want. Whether you want interests or units, a single class or multiple classes with separate preferences, pro rata profit distribution or a custom setup built on investor requirements, all of it can be structured in. Because it’s the most flexible though, it’s also extremely important that it’s formed properly at the beginning, with a robust Operating Agreement that accounts for all situations and scenarios. This is not the time for an online form, because the wrong provision could bankrupt you with tax liability, or dissolve the company when it’s at the brink of greatness. If formed properly though, you can proceed to reap the benefits with really little in the way of formalities, and a nice rulebook for when changes are necessary.

While multi-member LLCs are pass through entities by default, and taxed as partnerships, an LLC can choose to be taxed as a corporation or S-Corp if they find it more beneficial.

LLCs are the perfect vehicle for many businesses, but if you expect to grow really big, plan to take on serious investors, or ever want to go public, it might make sense to at least consider a Corporation before jumping in.

Corporations

Corporations are structured as a vehicle for growth. Putting aside closely held corporations, which a lot of states don’t have, here’s how they work.

The company is owned by shareholders, who purchase their shares (either with cash, intellectual property, or sometimes labor); ownership isn’t automatic.

The shareholders elect the board of directors, who meet on a regular basis to set the vision for the company, and who are in charge of electing the executive officers, or the “C-suite.”

The C-suite is responsible for day-to-day operation of the company.

The C-Suite serves the directors, and the directors serve the shareholders.

The company pays employees, and the company itself gets taxed on any profits.

·Any remain profits can be distributed to the shareholders based on the type of share they own. The shareholder gets taxed on this “distribution.”

There’s a lot going on above, and aside from those sneaky closely held corporations, running a corporation requires a lot of formalities, like: a) holding regular meetings of the directors, b) holding annual meetings of the shareholders, and c) heavily documented decisions at each, all in accordance with the governing documents of the corporation. In fact, any major decision made by those in charge should be documented with votes.

A lot of people don’t like corporations because of the double taxation, where the company gets taxed on its profits, and the owners get taxed on any distributions they receive from the remaining profits. That’s a real thing, and for a lot of smaller companies it just doesn’t make sense. That said, corporations have some pretty massive benefits.

A lot of investors really like corporations because they don’t have pass through taxation like LLCs and Partnerships do. This means that the profits and losses fall to the company itself, and the investors don’t have to worry about dealing with taxes from every company they invest in. Laws related to corporations are also much more developed than LLCs or LLPs because they’ve been around longer; case law has become fairly established, so the outcome in a situation is a lot more predictable with corporations. Additionally, if you ever want to go public (which is basically a mechanism for getting a lot of investors at once), you’ll need a corporation before you can hit the stock market.

Benefit Corporations

Benefit Corporations are a pretty new vehicle, and as of writing this, 36 states in the US recognize them. Benefit corporations are different from B Corps in that “B Corp” is a certification, kind of like “certified gluten free” or “fair trade certified.” Benefit Corporations are basically corporations that take on a higher purpose.

Traditionally speaking, a corporation has one specific purpose—increasing shareholder value. When you buy shares of a company, at least in the initial stages, the purchase price is linked to the value of the company. As the value of the company increases, the value of each share allegedly increases, bringing financial growth and benefit to the shareholders. This, from my understanding, was the entire premise of the 1980s.

Benefit Corporations are for-profit corporations that have goals larger than shareholder value. They also want to benefit the environment, or local communities, or those generally in need. In a normal corporation, any attempt to help the environment without some kind of related increase in sales would usually decrease rather than increase shareholder value. Putting profits aside for such a purpose would actually be against a corporation’s purpose, and potentially open the company up to a lawsuit from its shareholders. Not so with a Benefit Corporation. A Benefit Corporation is supposed to do more, and is actually held accountable by its shareholders through an annual report, and with high levels of transparency throughout its annual cycle. If you’ve considered opening a non-profit, but really do want to focus on building a for-profit company, and you believe you can bring these ideals together without conflict, then a Benefit Corporation may be an ideal option for you.